What is the lending tech stack?

The lending technology stack is the ecosystem of tools and services that enable today's fintech companies to handle everything from originations to servicing quickly and reliably—without having to bring on the teams of finance and technology experts that developing these functions traditionally required.

All lenders need to originate and service loans, but the ones that can leverage technology to do so reliably and cost-effectively are the ones that will win in the long-term. That's why crafting the right lending tech stack is usually the top business priority for modern lenders looking to scale their operations.

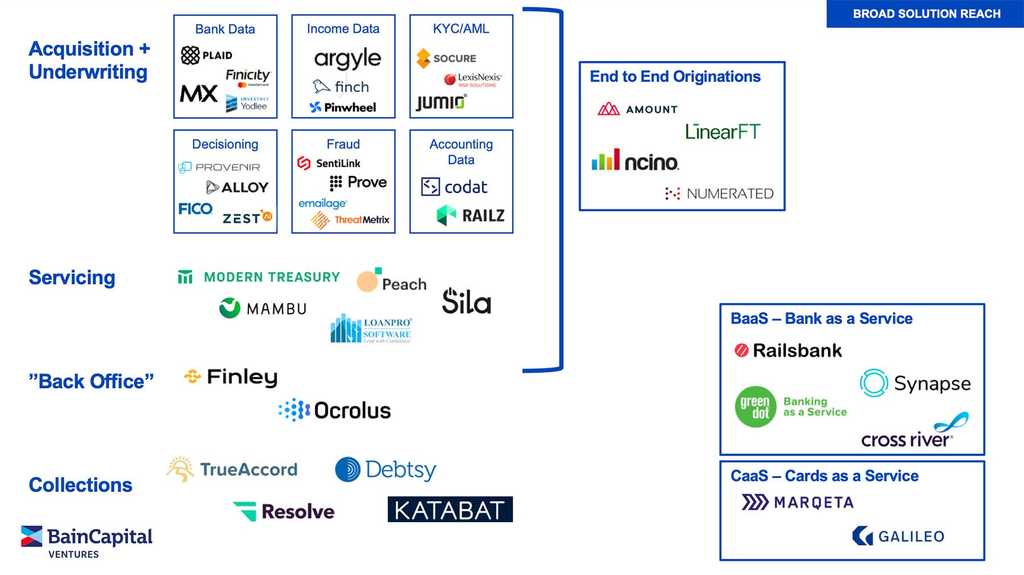

Below, we show the modern lending technology stack that our CEO Jeremy Tsui recently presented onstage with Noah Breslow (Bain Capital Ventures) and Hannah Arnold (Argyle) at the 2021 Lend360 conference.

The term "tech stack" originally comes from software development, where it refers to the ecosystem of tools, services, and frameworks that make up a given software product. At a high level, a software tech stack may have a database layer, a back-end layer, a front-end (i.e., user-facing) layer, and perhaps analytics tools to monitor user behavior. These tools may be proprietary or open source, but they have to work together in order for the tech stack to be effective, so careful thought and planning must go into the construction of the full technology stack.

Just as the proliferation of tools for marketing and sales has led to the development of a "marketing technology stack" and a "sales technology stack", there is now an emerging "lending technology stack" that enables fintech companies to get up and running faster than ever before—without having to compromise on compliance or cost. This tech stack is broadly consistent across different types of fintechs; the "BNPL tech stack" and "credit card tech stack," for example, would both have all of the layers we describe below.

So what's the perfect fintech stack? It depends on what you're optimizing for (e.g., time to market, scalability, configurability). Here, it's useful to consider the "build vs. buy" frameworks that companies and engineering teams have traditionally used to evaluate software purchasing decisions.

When designing a tech stack, engineering teams generally make trade-offs between factors like cost, ease of maintenance, scalability, and other scaling factors. You want to choose tools that save time on development and get the job done today, but remain interoperable with new technologies and frameworks down the line. The same considerations apply when designing your lending technology stack.

What are the key layers in the lending technology stack?

As shown in the diagram above, there are four key layers in the lending technology stack: Acquisition & Underwriting, Servicing, Back Office Enablement, and Collections. Additionally, there are consolidated solutions like End-to-End Originations solutions, Banking as a Service (BaaS) providers, and Cards as a Service (CaaS) offerings that are relevant for select lenders. Because not all modern lenders are, for example, card companies, the latter categories tend to be optional components of the lending tech stack.

Below, we walk through the key functions of each key layer of the lending tech stack:

Acquisition & Underwriting. Perhaps the most important job of the fintech lender is to acquire customers and accurately assess their creditworthiness. (Indeed, a fintech's "secret sauce" is often its ability to take widely available data and apply proprietary data models to it to find untapped market segments.)

The data used to assess customers has to come from somewhere, which is why this layer has so many different data vendors. The different types of data vendors in the Acquisition & Underwriting layer of the lending tech stack include bank data integrators (e.g., Plaid and Finicity), accounting data integrators (e.g., Codat and Merge), and income data providers (e.g., Argyle and Finch).

Right off the bat, you can see how fintech companies focusing on different types of underwriting—income-based consumer lending versus revenue-based SMB lending, for example—will need to ingest, model, and process data differently. In addition, the Acquisitions and Underwriting layer includes fraud detection solutions that further help lenders drive down delinquency rates.

Servicing. The Servicing layer of the lendtech stack is less mature than the Acquisition & Underwriting layer, partly because the servicing needs of today's fintechs tend to be bespoke (i.e., asset type-dependent), and partly because some integral aspects of loan servicing, such as wire reconciliation, have not traditionally been offered as third-party offerings. Think of it this way: a servicing solution for retail BNPL would have very different specifications than a tool for servicing student loans, even though both would require advanced payment reconciliation capabilities.

Servicing solutions also need to take in the data generated during the Acquisition & Underwriting step, which can present data engineering and standardization challenges that preclude the use of a third-party servicing solution. In short, end-to-end servicing requires many building blocks that aren't yet available on the market. That said, the rise of payment operations platforms like Modern Treasury is likely to establish a platform on which "off-the-shelf" servicing software can be built.

Back Office Enablement. Back Office Enablement is the newest layer of the lending technology stack, so we wouldn't be surprised if it splinters into a few different layers as the fintech ecosystem evolves.

For now, this layer includes software for helping lenders manage their funding (see our previous post on how Finley enables fintech debt capital management), software for automating routine document processing processes, and more. As lending technology progresses, you can expect Back Office functions to be the weak link in many fintechs' operations, especially in lending categories where data standardization and reporting are labor-intensive.

As with Servicing, the suitability of tools in the Back Office Enablement category depends on what types of financial products a fintech originates, as well as the current state of its data engineering operations.

Collections. The final layer of the lending tech stack is Collections, where companies like TrueAccord and Debtsy offer digital debt collection services. Because fintech lending is still nascent, these types of offerings have not been tied exclusively to fintech lenders, and have sometimes gone to market by partnering with traditional lenders. As such, the Collections layer is not a requirement for many fintechs.

Want to learn more?

Selecting the right lending tech stack is essential to the long-term success of your business. However, simply buying the right software isn't enough; your fintech also needs to combine that software with the right people and processes to succeed. In a future post, we'll share our best practices on setting up the right internal processes and teams after establishing your lending tech stack.

In the meantime, if you're interested in learning more about software that can help you streamline your debt capital raise and management, just schedule a demo or take a self-guided product tour of Finley. We'd love to chat!