At Finley, we’re dedicated to streamlining every step of debt capital management. By bridging the gap between complex data, workflows, and insights, we empower lenders and corporate borrowers to make the most of their debt portfolios. Our innovative software solutions make managing capital markets operations simpler and more efficient.

Here’s what we've released this month:

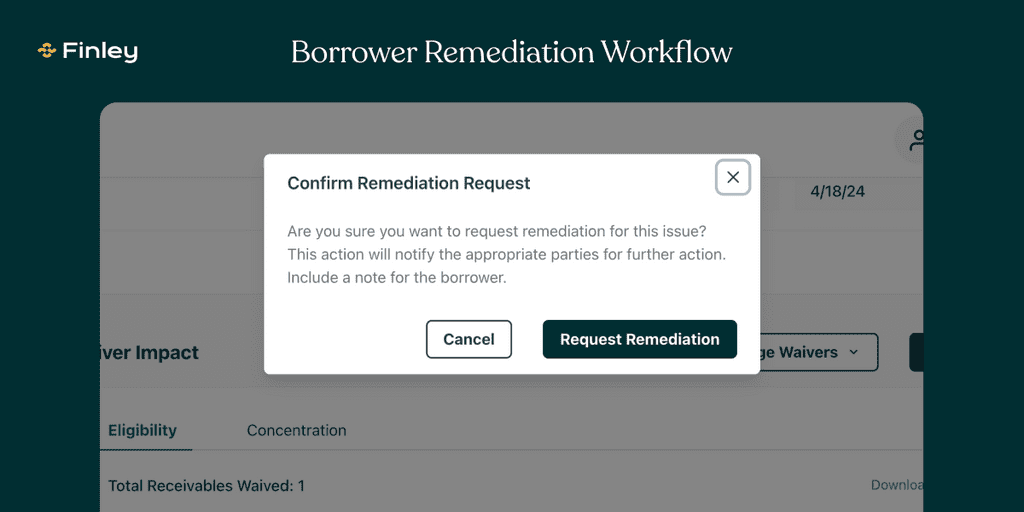

Borrower Remediation Workflow

We introduced a new borrower remediation workflow to our Finley portal. This innovative feature enhances the efficiency and accuracy of the verification workflow, which allows lenders to seamlessly confirm borrowing base calculations submitted by their borrowers against the results of Finley's software-based calculation agent.

Previously, lenders had to contact borrowers manually to request updates or corrections to their reports. This typically required lenders to identify discrepancies offline and communicate them via email, instructing borrowers on the necessary changes before they could submit a new report.

Now, the process is dramatically streamlined within the Finley platform. After reviewing the verification report, lenders can directly send Remediation requests through the portal. Borrowers, in turn, receive access to a limited view of the Finley portal, where they can easily see the discrepancies, understand the expected values of the borrowing base, and upload the remediated report.

This new workflow simplifies communication between lenders and borrowers and ensures that all data and calculations are reviewed and rectified efficiently within a single, integrated system. It’s a more straightforward and effective way for lenders to manage and verify financial data, ensuring accuracy and clarity in every report.

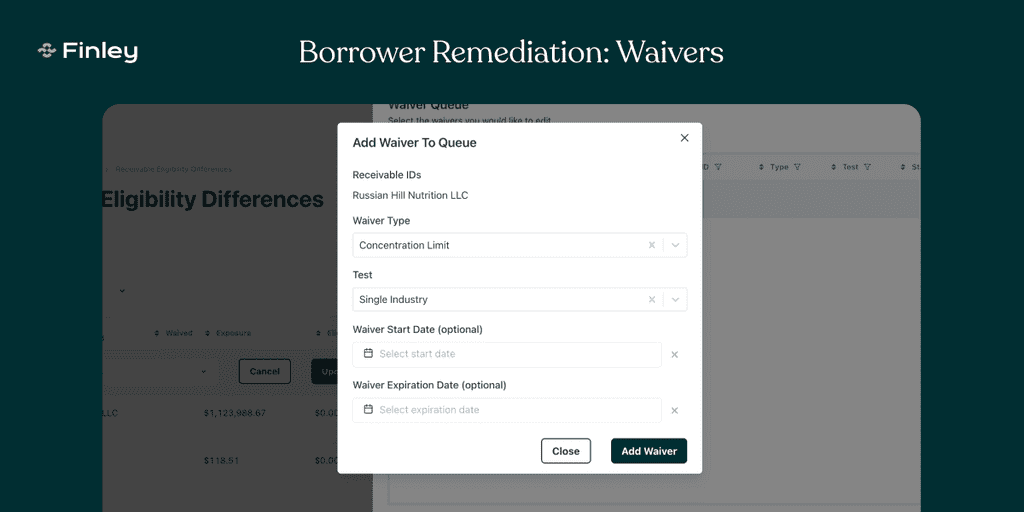

Borrower Remediation: Waivers

Borrowers and lenders can now apply waivers for eligibility or concentration limit tests for specific receivables directly within Finley's platform. This new functionality allows lenders and borrowers to apply any agreed-upon waivers directly within the dashboard and recalculate the borrowing base, all within the same flow.

With this new feature, borrowers and lenders can:

👉 Add or edit new waivers

👉 Select receivables that they want to apply waivers against

👉 Recalculate the borrowing base to review the impact of waivers

Users can manage the duration of these waivers—setting them up indefinitely or for a specific timeframe. Once these waivers are applied, they are automatically considered during the calculation verification process.

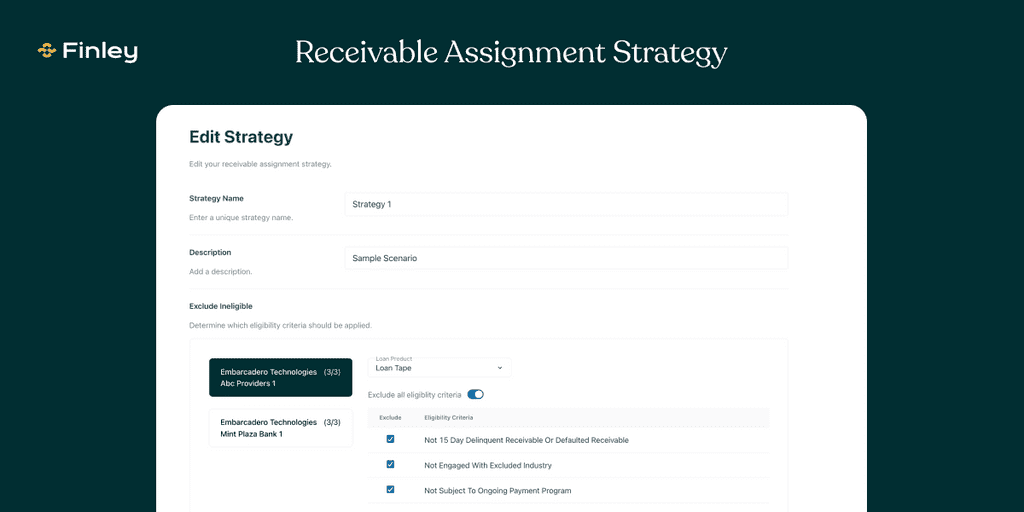

Receivable Assignment Strategy

Borrowers often face decisions about which subsets of their collateral to pledge, especially when dealing with receivables that may not meet eligibility criteria or that could significantly impact concentration limits. Additionally, borrowers with multiple facilities might prefer to allocate different subsets of their collateral to each facility based on varying strategic needs.

With the new assignment strategy feature, borrowers can apply sophisticated filtering logic to their total receivable base, enabling them to choose precisely which receivables to pledge. This tool allows users to review the impact of these decisions on the borrowing base before making any funding requests to lenders. For instance, users can opt to exclude receivables likely to fail eligibility tests or selectively assign receivables, excluding those that meet specific unfavorable criteria.

Users can now establish complex assignment strategies within Finley, ensuring that only the receivables meeting the preset criteria are considered in the shared master data tape. Finley provides a comprehensive breakdown of the borrower’s current portfolio alongside a proposal of what the portfolio will look like after new assignments.

Learn More

Finley is private credit management software that helps private credit borrowers and asset managers streamline and monitor asset-backed loans. From tracking covenants and deliverables, to assembling funding requests and analyzing asset performance, Finley gives borrowers and lenders peace of mind when it comes to debt capital management. For more, check out our Product page.

If you want to learn more about software that can help you streamline your debt capital raise and management, just schedule a demo. We'd love to chat!