Overview

Funding requests are the transactions, or building blocks, of a company’s debt capital and capital markets operations, particularly if that company has taken on a warehouse line of credit. They're how companies access credit, pay down their balance, or ensure that the right amount of money is in the right account, prior to originating a new loan.

However, the processes behind these requests are opaque and involve a number of different entities and bank accounts, which can make them difficult to understand. In this post, we'll explain the three main types of funding requests involved in revolving, asset-backed credit facilties: draw requests, recycling requests, and paydowns.

Funding Request Background

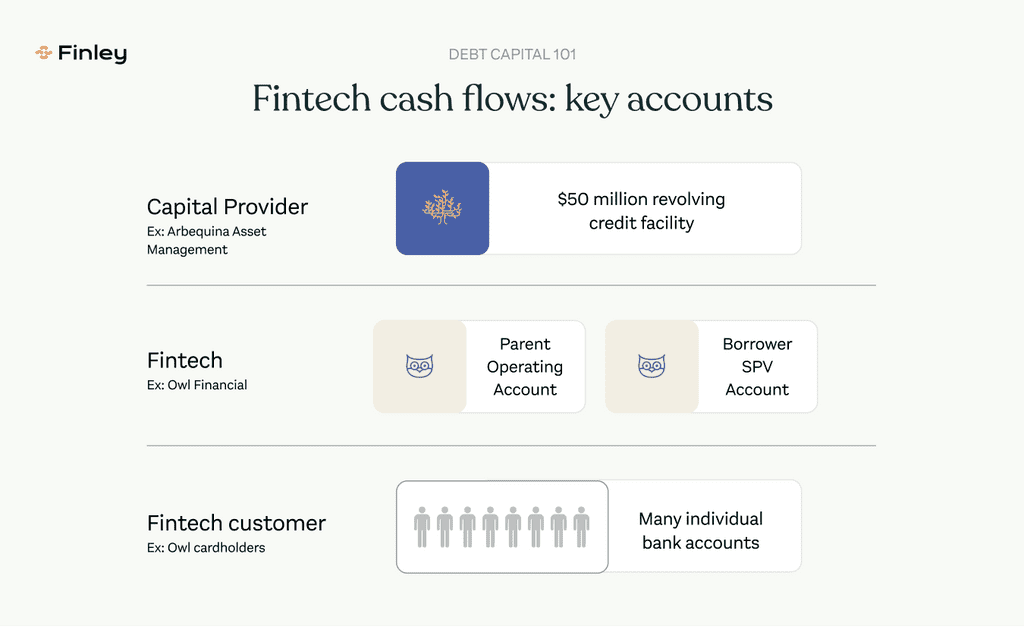

Before getting into the mechanics of funding requests, it's important to understand the key bank accounts involved, which we previously covered in our post on fintech cash flows.

ACCOUNTS

The parent company–or the borrower–does its primary banking through Parent Operating Account.

In addition the Parent Operating Account, asset-backed loans require a Special Purpose Vehicle, or SPV, a separate legal entity from the Parent. In the diagram below, we simplify the SPV and treat it as one account, but it's more accurate to think of the SPV as the entity that holds both the Collections Account and the Funding Account.

PROCESS

For fintech, proptech, and other companies that utilize asset-backed debt raises, there are three steps to most funding requests.

1. Funding request preparation and submission. In the first step of this process, borrowers must collect documents–such as a borrowing base report and compliance certificate–and prove compliance with the conditions associated with funding requests (i.e., conditions precedent).

Once they've done so, borrowers can size their collateral to determine their borrowing base; if their borrowing base is larger than their outstanding balance, they may initiate a funding request, with their credit agreement outlining the exact amount they can request. For more on borrowing base Excel templates, check out our previous post on how borrowing base Excel spreadsheets work.

2. Funding request approval. Once capital providers receive those documents, they will review them and attempt to verify their accuracy. Often, they will request additional information before approving the funding request. For more information on the approval process, see our previous posts on draw requests and verification agents.

3. Funding request disbursement. Finally, capital providers disburse the requested funds to borrowers.

There are certain restrictions associated with funding requests, with a notable one being the Deposit Account Control Agreement (DACA), or lockbox account. In the recycling process, the lender may need to approve the wire from the Borrower’s Collections Account to the Parent Operating Account. Because the SPV’s Collections Account serves as collateral for their facility, the lender may want to utilize a DACA to protect themself against the risks of extending credit.

For example, a DACA may allow the lender to seize control over the account if the borrower goes into bankruptcy. It may also provide the lender with formal approval over the actions that take place over the account, such as recycling requests.

Usually, to be approved for the wire transfer, borrowers will provide their borrowing base report and documentation of their cash, loans, and outstanding balance on their facility (to see how we can help, check out our Draw Request Deep Dive). If approved, the capital provider can then approve and initiate a one-way wire to the Parent account from one of the SPV accounts.

An SPV’s cash reserve often restricts how much a borrower can recycle. For example, a credit agreement might stipulate that an SPV must retain a reserve in the Borrower’s Collections Account as a safeguard for lenders who want to ensure that they will be paid by the next payment date.

The cash reserve is also helpful in instances where the borrower needs to pay interest calculations or other fees associated with their facilities. Combined, this means that the borrower may not be able to recycle all of the cash in their Collections Account.

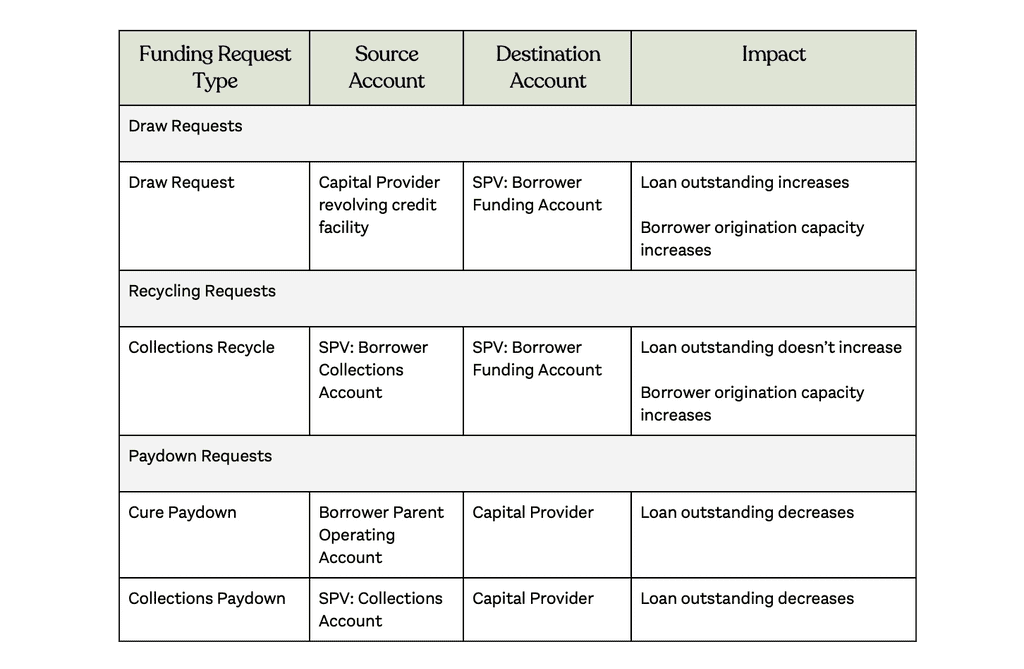

Funding Request Types

DRAW REQUESTS

A borrower can make a draw request to receive funds from their capital provider, and it can often be initiated at the same time as a recycling request. Borrowers usually size their draw requests to their eligible collateral assigned to a capital provider.

RECYLING REQUESTS

Recycling requests are the most complex of the three processes discussed and involve close interactions between the Parent company, the SPV, and the capital provider.

Suppose you, as the borrower, have $100 in loans. Your lender utilizes a 90% advance rate, meaning that for every $100 of collateral, the lender will supply $90 in funding. The other $10 is up to you to finance using cash or equity.

Over the period of a month, customers pay down their balances, and you receive the $100 in loans back. The cash from these repayments makes its way to the Collections Account. Now, you'd like to make sure the money collected can be used to generate more originations. At this point, a recycling request is the logical next step to put your cash to work, and you can initiate one at the frequency stated in your credit agreement.

Collections Recycling Request. A recycling request comes with a few preconditions, called conditions precedent: For example, do you have a borrowing base deficiency? Do you have sufficient assets to support your outstanding balance? If you have enough assets to collateralize your facility, then you can request to recycle your cash. After your request is approved, you can transfer and wire the cash from the Borrower’s Collections Account to the Parent Operating Account or Funding Account to fund the origination of additional receivables.

PAYDOWN REQUESTS

Paydowns are repayments on loans. Outside of the payment waterfall, paydowns can come in two different types, with their main distinction being the source of the money used to pay down their accounts.

For any paydown, legal requirements outlined in the credit agreement govern what actions can be taken. We explain two common types of paydowns below.

Cure Paydown. When an SPV does not have enough assets to support the outstanding balance on their facilities (a borrowing base deficiency), the Parent must pay down the credit facility by wiring the outstanding from the Operating Account to the lender. By injecting external cash into the facility, the Parent is “curing” the SPV and getting it back into compliance.

Collections/Recycle Paydown In a recycle paydown, the borrower uses their Collections Account (in the SPV) rather than the Parent Operating Account to repay their loans.

Want to learn more about Finley?

Finley is private credit management software that helps Finance and Capital Markets teams manage asset-backed loans. Our software accelerates funding transactions and minimizes risk by automating routine debt capital management tasks like borrowing base reporting, verification, and alerting.

Today, Finley manages over $3 billion in debt capital for customers like Ramp, Parafin, and Arc. If you want to learn more about software that can help you streamline your debt capital raise and management, just schedule a demo. We'd love to chat!