What are debt capital integrations?

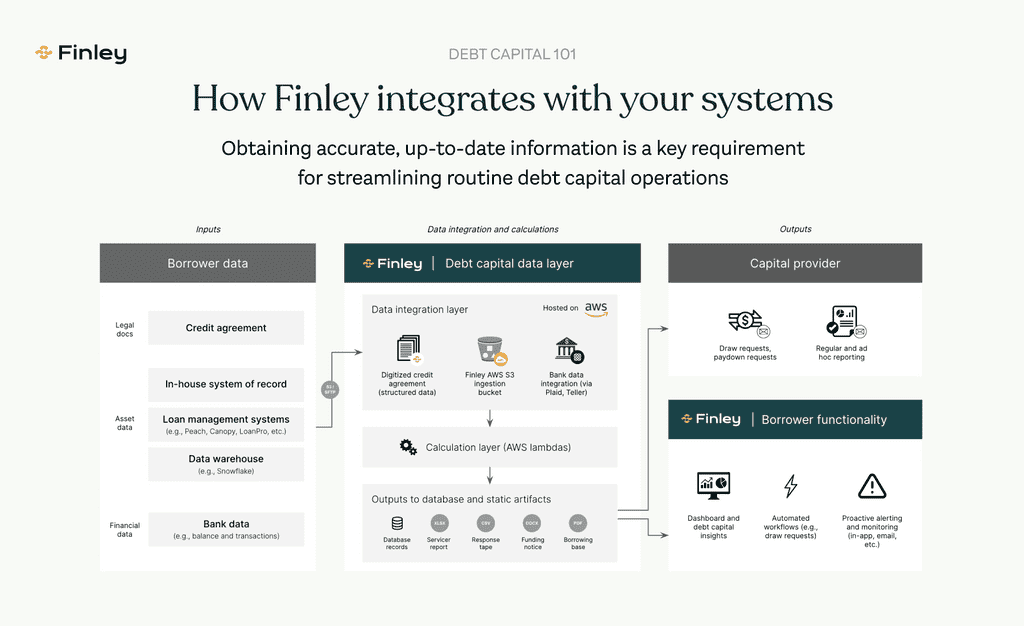

Debt capital data integrations are how Finley's software transfers information to and from your existing financial and software systems. Our debt capital automation, alerting, and compliance capabilities require accurate, up-to-date data, so we've invested significant engineering resources in making sure that information flows seamlessly between Finley and a variety of different data providers.

For example, this information could be bank data from your collections account, origination data (in the form of a loan tape) from your loan management system, or other information needed to produce a borrowing base Excel spreadsheet for your capital provider.

Finley also digitizes your credit agreement and turns the unstructured information in the contract into structured data (e.g., storing financial covenant thresholds in a database). However, this part of our software is a one-time data extraction process, and not a continuous data integration, so we won't examine it here.

How does Finley integrate with asset data?

Finley takes in CSVs of loan tapes, so it can work with virtually any Loan Management System (LMS), including LoanPro, Peach, and Canopy.

Of course, it's also common for lending companies to create their own loan management system or to enrich LMS data with data from other sources (e.g., firmographic or verification data), and to surface this data through a data warehouse (e.g., Snowflake) or a BI tool (e.g., Tableau). Finley integrates with these systems as well, and can perform the same types of data QA and verification as it does with data from an LMS.

When it comes to data transfer method, Finley is vendor-agnostic and can transfer data via AWS S3, GCP, Microsoft Azure, or SFTP. (You can find further information on these methods in our Knowledge Base.)

How does Finley integrate with bank data?

There are a number of borrower and lender bank accounts that are involved in the cash flows of financial technology and other lending companies. Tracking balances across bank accounts is one way of ensuring that all debt capital transactions are: a) happening in the right sequence, and b) in line with the rules of the credit agreement.

Capital providers may want to know how much money is in a collections account before approving a funding request, for example, or check for compliance with a liquidity covenant by verifying a parent operating account balance.

By integrating with your bank data, Finley is able to auto-populate reports, funding requests, compliance certificates, and other deliverables with accurate balance data without requiring manual updates. Today, our software provides bank data integrations via Plaid or Teller, both of which are accessible from the Finley Settings page.

In addition, Finley integrates with third-party interest rate data providers in order to reliably pull Secured Overnight Finance Rate data that may be required by capital providers as part of a monthly reporting package or other submission.

Want to learn more?

Finley is private credit management software that connects to your existing systems and helps you automate routine debt capital management tasks like borrowing base reporting, receivable assignment, and alerting. Today, Finley manages over $3 billion in debt capital for customers like Ramp, Parafin, and TripActions.

We pride ourselves on having accessible product documentation; you can view our product Knowledge Base here.

If you're interested in learning more about software that can help you streamline your debt capital raise and management, just schedule a demo or take a self-guided product tour. We'd love to chat!